The Arctic wasn’t always frozen and lifeless. Millions of years ago, parts of northern Greenland were wet, green, and alive with flowing water. Beneath its present-day ice, a cave now holds evidence of that forgotten warmth.

A team of scientists…

The Arctic wasn’t always frozen and lifeless. Millions of years ago, parts of northern Greenland were wet, green, and alive with flowing water. Beneath its present-day ice, a cave now holds evidence of that forgotten warmth.

A team of scientists…

Guests enjoy the Fortune Global Forum 2025 Gala Dinner on October 26, 2025 at Diriyah Gate, Riyadh, Saudi Arabia.

Cedric Ribeiro | Getty Images Entertainment | Getty Images

Mining executives have welcomed a sharp upswing in investor interest from the Middle East, as Gulf states seek to expand their critical mineral ambitions and take on established global players.

Critical minerals refer to a subset of materials considered essential to the energy transition. These resources, which tend to have a high risk of supply chain disruption, include metals such as copper, lithium, nickel, cobalt and rare earth elements.

“The interest in rare earths in this part of the world is phenomenal,” Tony Sage, CEO of U.S.-listed rare earths miner Critical Metals, said during a business trip through the Middle East.

“I didn’t expect it because, you know, they can’t mine it. There [are] really no discoveries in this area, but they want to be able to participate somehow in the downstream,” Sage told CNBC by telephone.

His comments come as policymakers and business leaders flock to Saudi Arabia’s Future Investment Initiative (FII) in Riyadh, an event nicknamed as the “Davos in the Desert.”

The annual event, which got underway on Monday, is being held under the theme: “The Key to Prosperity: Unlocking New Frontiers of Growth.” It is expected this year’s FII will lean into areas such as artificial intelligence, particularly as the oil-rich kingdom continues with its mission to diversify its economy.

A wheel loader takes ore to a crusher at the MP Materials rare earth mine in Mountain Pass, California, U.S. January 30, 2020.

Steve Marcus | Reuters

Analysts say Gulf states, led by the likes of Saudi Arabia and the UAE, are increasingly seeking to leverage their financial capital and geographic location to capture critical minerals market share.

A series of targeted acquisitions and international partnerships forms a key part of this regional strategy, according to an analysis by the International Institute for Strategic Studies (IISS), with Gulf states seeking to present themselves as alternative partners to Western nations.

Critical Metals, for its part, has partnered with Saudi Arabia’s Obeikan Group to build a large-scale lithium hydroxide processing plant in the kingdom.

Kevin Das, senior technical consultant at New Frontier Minerals, an Australian-based rare earths explorer, linked investor interest in rare earths from the Middle East to exponential growth in the field of AI.

“It’s no surprise that you’re seeing interest, not just in the Western world, but spreading into the Gulf States because I think people are realizing that we’re probably on the cusp of an AI boom,” Das told CNBC by telephone.

“If you start to see the emergence of robotics, every robot is going to need these rare earths. And I think the supply is only going to get tighter,” he added.

Rare earth elements have emerged as a key bargaining chip in the ongoing U.S.-China trade war, although global stocks rallied on Monday amid investor hopes of thawing tensions between the world’s two largest economies.

U.S. officials have touted the prospect of China delaying strict rare earth export controls as part of a high-stakes summit between President Donald Trump and China’s Xi Jinping on Thursday.

Rare earths refer to 17 elements on the periodic table whose atomic structure gives them special magnetic properties. These elements are widely used in the automotive, robotics and defense sectors.

U.S. President Donald Trump meets with Saudi Crown Prince Mohammed bin Salman during a “coffee ceremony” at the Saudi Royal Court on May 13, 2025, in Riyadh, Saudi Arabia.

Win Mcnamee | Getty Images News | Getty Images

Shaun Bunn, managing director at London-listed Empire Metals, said his company had also received considerable investor interest from the Middle East.

“I think that it is very much part of the kingdom’s strategic push to diversify away from its oil. I mean, they are always going to make the most money out of oil at the moment at least, but they are trying to diversify,” Bunn told CNBC by telephone.

Analysts have flagged a number of barriers facing the Gulf states’ push for critical minerals, however, noting that regional players remain marginal producers at present.

“Many of Saudi Arabia’s mining ventures remain in early or even conceptual stages, and the country still depends on foreign partners for expertise, such that it may take years for Saudi Arabia, and the Gulf states more generally, to scale up enough to dent Chinese dominance or to fully meet Western demand,” Asna Wajid, research analyst at IISS, said in an analysis published in late July.

“Many in the West, moreover, may be wary of replacing their dependence on China with dependence on the Gulf states, which already exercise considerable strategic leverage due to their oil and gas supplies,” Wajid said.

China is the undisputed leader of the critical minerals supply chain, producing roughly 70% of the world’s supply of rare earths and processing almost 90%, which means it is importing these materials from other countries and processing them.

U.S. officials have previously warned that this dominance poses a strategic challenge amid the pivot to more sustainable energy sources.

GSK plc (LSE/NYSE: GSK) and Empirico Inc. (Empirico), a clinical-stage biotechnology company with leading capabilities in human genetics-driven target discovery and siRNA medicines, today announced that they have entered into a worldwide…

At the same time, Kenya’s KEMRI laboratory as well as South Africa also expanded its sequencing capacity, further stepping up the region’s ability to detect and respond to poliovirus swiftly.

Then in October, Nigeria launched an integrated…

Hoyoverse has just released the new Myriad Celestia Trailer “Exotale: Scene 8.” This trailer reveals the possible outcomes of Trailblazing if the players hadn’t head over to Amphoreus. It appears that Amphoreus was the most ideal…

(Bloomberg) — Global equities paused their record-breaking rally as investors braced for a flurry of earnings from megacap technology companies and policy announcements from major central banks this week.

Asian shares fell 0.5% and futures pointed to a weaker open for Europe. Japanese shares retreated from a record as the yen gained against the dollar, snapping a seven-session slide. Contracts for the S&P 500 were flat after the gauge closed at a record as Chinese and US trade negotiators lined up an array of diplomatic wins for Donald Trump and Xi Jinping to unveil at a summit this week.

“What we’re hoping is for some agreement with hard numbers,” Lorraine Tan, director of equity research for Asia at Morningstar, said in a Bloomberg TV interview. “We’re still going to be skeptical in effect that we do expect heightened risks from tariffs and geopolitics — there is no escape from that.”

Easing trade tensions have helped fuel a stock rally, while US companies have so far emerged largely unscathed by tariffs, protecting margins through price increases and cost cuts. That optimism faces a reality check this week as investors look to the Federal Reserve meeting for clues on the path of rate cuts, while major technology firms including Amazon.com Inc. and Microsoft Corp. reveal whether the earnings momentum can be sustained.

Meanwhile, the yen gained against the dollar after US Treasury Secretary Scott Bessent and newly appointed Japanese Finance Minister Satsuki Katayama discussed exchange rate volatility.

The yen outperformed its Group-of-10 peers, as markets welcomed supportive remarks from Japanese officials and cheered the outcome of a high-profile meeting between US and Japanese leaders in Tokyo. The currency gained also as Japan’s minister for growth strategy Minoru Kiuchi said authorities will keep monitoring the impact of yen weakness on the economy.

What Bloomberg strategists say…

FX traders are reading it to be a reminder that the US administration would prefer a softer dollar. However, the Bank of Japan still needs to do their part this week and set up a rate hike for December. Otherwise USD/JPY could flip back to the 153 area, or higher.

— Mark Cranfield, Markets Live strategist. Click here for the full analysis.

In other corners of the market, the yuan climbed to its strongest level in nearly a year, amid optimism over a potential China-US trade deal. A gauge of the dollar edged lower for a second day. Gold held below $4,000 an ounce as progress in trade talks sapped demand for haven assets.

On Wednesday and Thursday, five firms that account for about a quarter of the US benchmark — Microsoft Corp., Alphabet Inc., Meta Platforms Inc., Amazon.com and Apple Inc. — will report results. A gauge of the “Magnificent Seven” megacaps jumped 2.6% on Monday.

“With the Fed on track to cut rates, extending the run would appear to hinge on this week’s lineup of high-profile earnings releases,” said Chris Larkin at E*Trade from Morgan Stanley.

Copper — a bellwether for global growth — advanced and traded roughly $60 shy of a record set last year as investors assessed the cooling of trade tensions between the US and China.

On trade, Trump told reporters on Monday that “I really feel good” about a deal with China, after officials unveiled a slew of agreements to ease tensions.

While markets cheered the latest developments, some analysts cautioned the deal now teed up for Trump and Xi to sign in South Korea ignored thorny issues.

Fundamental fights over national security appeared untouched, they said, along with Trump’s stated core mission of rebalancing trade. Making that harder, Chinese investment into America remains heavily restricted.

“While these developments have lifted market spirits, analysts remain skeptical that the underlying issues — such as national security and tech competition — will be fully resolved,” said Fawad Razaqzada at City Index and Forex.com. “Nevertheless, traders have embraced the risk-on mood.”

Meanwhile, Trump hailed the US’s alliance with Japan, reaffirming ties with a longstanding partner and praising new Prime Minister Sanae Takaichi on her plans to ratchet up defense spending as the pair met in Tokyo. Trump and Takaichi signed a framework on critical minerals.

Corporate News:

Amazon.com Inc. to cut corporate jobs in several key departments, including logistics, payments, video games and the cloud-computing unit, according to people familiar with the matter. The terminations, expected as soon as Tuesday, could affect as many as 30,000 jobs, Reuters reported on Monday, citing sources. HSBC Holdings Ltd. reported third-quarter revenue that beat estimates, driven by its key wealth businesses, even as a $1.1 billion provision tied to the Bernard Madoff fraud cases weighed on earnings. BNP Paribas SA’s trading unit suffered a hit from souring debt in the third quarter, adding to challenges for Chief Executive Officer Jean-Laurent Bonnafe after a string of recent setbacks. Novartis AG’s profit rose last quarter, buoyed by a suite of new cancer medicines. Amundi SA reported adjusted pretax income for the third quarter that beat analysts’ estimates as the French asset manager prepares to unveil its new three-year strategic plan next month. Nvidia Corp. and Deutsche Telekom AG are preparing to announce plans for a €1 billion data center in Germany. BlackLine Inc. has attracted takeover interest from suitors including SAP SE, according to people with knowledge of the matter. Nomura Holdings Inc.’s profit beat analysts’ expectations last quarter, buoyed by equity trading and advising on mergers. Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:50 a.m. London time Nasdaq 100 futures were little changed The MSCI Asia Pacific Index fell 0.5% Hong Kong’s Hang Seng fell 0.5% The Shanghai Composite fell 0.3% Euro Stoxx 50 futures fell 0.1% Currencies

The Bloomberg Dollar Spot Index fell 0.1% The euro rose 0.1% to $1.1660 The Japanese yen rose 0.6% to 151.95 per dollar The offshore yuan rose 0.2% to 7.0976 per dollar The British pound rose 0.2% to $1.3358 Cryptocurrencies

Bitcoin fell 0.4% to $114,056.62 Ether fell 0.6% to $4,104.43 Bonds

The yield on 10-year Treasuries declined one basis point to 3.97% Japan’s 10-year yield declined 2.5 basis points to 1.640% Australia’s 10-year yield declined one basis point to 4.17% Commodities

Spot gold fell 1% to $3,943.59 an ounce West Texas Intermediate crude fell 0.2% to $61.18 a barrel This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alex Gabriel Simon.

©2025 Bloomberg L.P.

In the 1987 American action film RoboCop, protagonist Alex Murphy is a police officer in a dystopian 21st-century Detroit when he is mortally wounded and rebuilt by cybernetic enhancements so that he can keep fighting crime.

Nearly 40 years on, a…

The Democratic senator Elizabeth Warren is calling for an investigation into bankers including Jes Staley over their alleged support for the convicted sex offender Jeffrey Epstein, in a move that could leave the former Barclays boss banned from working in the US financial sector.

In a letter privately filed with regulators, and seen by the Guardian, Warren called for investigations into “all current and former US banking executives who may have facilitated Jeffrey Epstein’s illicit conduct”.

That includes Staley, who Warren said is alleged to have helped protect the late financier’s access to the banking system during his stint working at JP Morgan in the early 2000s. Warren noted that Staley – who is already banned from the UK banking sector – had been described in media reports as Epstein’s “chief defender”.

Warren, the lead Democrat on the US Senate committee on banking, housing and urban affairs, said she was concerned to hear that Staley pushed back when colleagues flagged Epstein’s suspicious transactions, referring to a matter that was put to him in court proceedings earlier this year. Staley denied the allegations at the time, saying “I don’t think that’s fair” and that the decision to exit a client such as Epstein was not his to make.

Warren also referred to court evidence suggesting Staley tipped Epstein off about JP Morgan’s worries in a way that allowed the sex trafficker to alter his behaviour and avoid scrutiny. Staley told the court that he “was not part of managing the account” but did not deny that he told Epstein there were concerns about cash withdrawals.

During his 15-year relationship with JP Morgan, Epstein opened at least 134 accounts, processed over $1bn in transactions, and brought in several lucrative clients, Warren’s letter said.

And while JP Morgan had so far paid $290m (£217m) in settlements to Epstein’s victims, “Staley has so far avoided accountability in the United States,” the senator said.

Warren has now called on the Federal Reserve Board, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) to publicly announce the launch of an investigation into former and current banking executives who may have aided Epstein, by 7 November.

She also asked for private confirmation that an investigation had been opened specifically into Staley’s conduct by 14 November. Wrongdoing could ultimately result in a fine and a potential ban from working in the US banking sector.

“It is critical to send a message to the public and current bank employees that this type of egregious misconduct has no place in the American banking system,” Warren’s letter said.

It would be another bruising development for Staley, who in June lost a legal attempt to overturn his lifetime ban from the UK financial sector imposed by UK’s Financial Conduct Authority (FCA) in 2023, after he was found to have misled the watchdog over his relationship with the sex offender.

The FCA’s original investigation, triggered by a cache of more than 1,200 emails between Staley and Epstein, concluded that the pair were “indeed close” and had a relationship that “went beyond one that was professional in nature”.

Warren also called for investigations into other top executives that may have supported the late financier’s crimes. “Staley is not the only bank executive with concerning ties to Epstein. For example, according to Staley’s sworn deposition, he discussed Epstein with CEO Jamie Dimon on at least two occasions,” the letter stated.

Dimon has previously denied Staley’s claim and stated that he does not recall knowing anything about Epstein until years after the firm effectively severed ties with the sex offender. JP Morgan declined to comment.

“The Fed, OCC and FDIC should investigate any other current or former banking executives who engaged in similar conduct to determine whether their conduct satisfies the legal standards for a ban on working in the banking industry and civil monetary penalties,” Warren said.

“Any banking executives who facilitated the crimes of one of the world’s most notorious sex criminals should be held to account,” Warren’s letter added.

Donald Trump has come under fire for his own social ties to the sex offender, who was a longtime friend until they fell out in 2004. The president made releasing the Epstein investigative files part of his campaign platform, but has failed to do so. He has referred to the furore over the files as a Democratic “hoax”.

The news of Warren’s letter came as two new lawsuits were filed by an anonymous plaintiff against Bank of America and the Bank of New York Mellon (BNY), alleging that banks illicitly enabled Epstein’s sex trafficking. BNY has said the claims “are meritless and we will vigorously defend against it”. Bank of America echoed those comments, saying: “We will vigorously defend ourselves in this matter.”

The Guardian contacted Staley’s legal representative for comment.

In June, after the loss of his legal challenge against the FCA, Staley said he was “disappointed” by the outcome but was “never dishonest”.

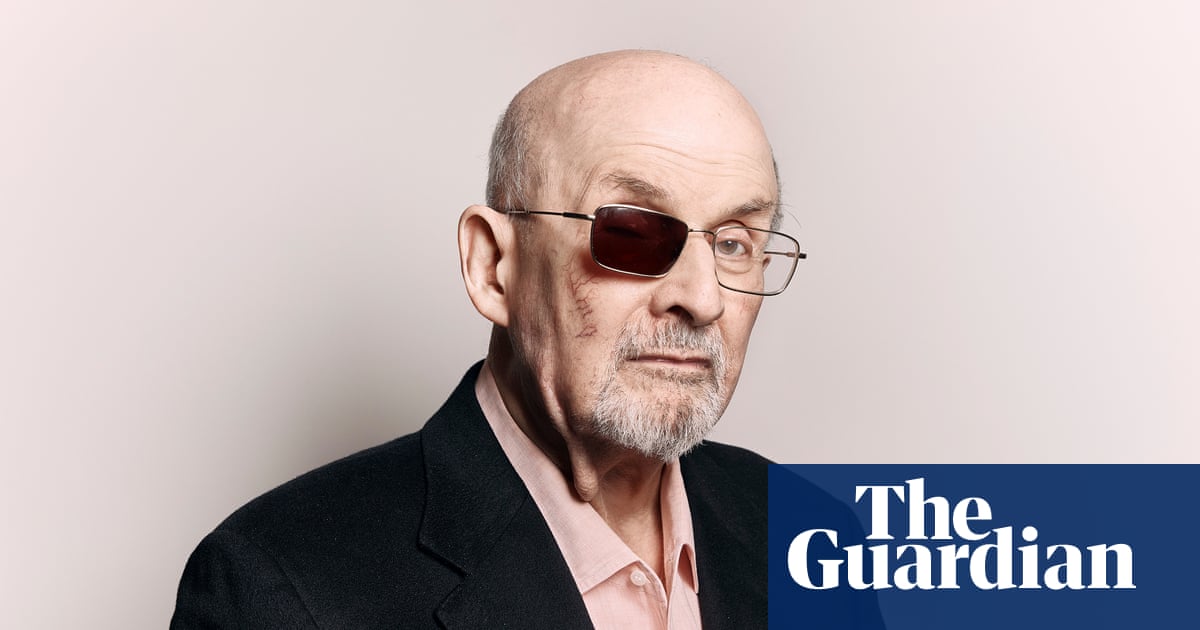

Towards the end of Knife, his 2024 book about the assault at a public event in upstate New York that blinded him in his right eye, Salman Rushdie offers a thought experiment:

Imagine that you knew nothing about me, that you had arrived from…

Japanese actor Lily Franky will appear in Wayne Wang’s next film “Diary of a Mad, Old Man,” revealed co-star Fan Bingbing at a Q&A session for the film “Mother Bhumi,” in competition at the Tokyo International Film Festival.

Continue Reading